Get A Home Loan Without The Hassle

Very low rates combined with excellent service

No docs required

No commitment

No credit score impact

Close-on-time guarantee

Get a Consultation

We will get back to you as soon as possible.

Please try again later.

Achieve Your Homeownership Goals Effortlessly

Loan options for every borrower

Our team will patiently guide you through every step of the mortgage process. Whether you’re refinancing, buying your first home, or purchasing an investment property, enjoy a stress-free financing experience

Stand out from the homebuying crowd

- We pre-approve you so sellers take you seriously

- Our close-on-time guarantee ensures you don’t miss out on your dream home

- We help you stand out against other offers in the most competitive markets

Guaranteed to close on time

We’ll pay you up to $3,000* if we’re at fault for missing your closing date.

A super competitive market means you have no room for mortgage financing errors. That’s why we’re willing to put our money where our mouth is.

If we don’t close on time, you’ll get paid.

*Terms and conditions apply

Mortgage Consultants in Huntington Beach

At The Mortgage Hub, we’re committed to making the mortgage process easier, faster, and more personalized—whether you're a first-time homebuyer, a seasoned investor, or somewhere in between.

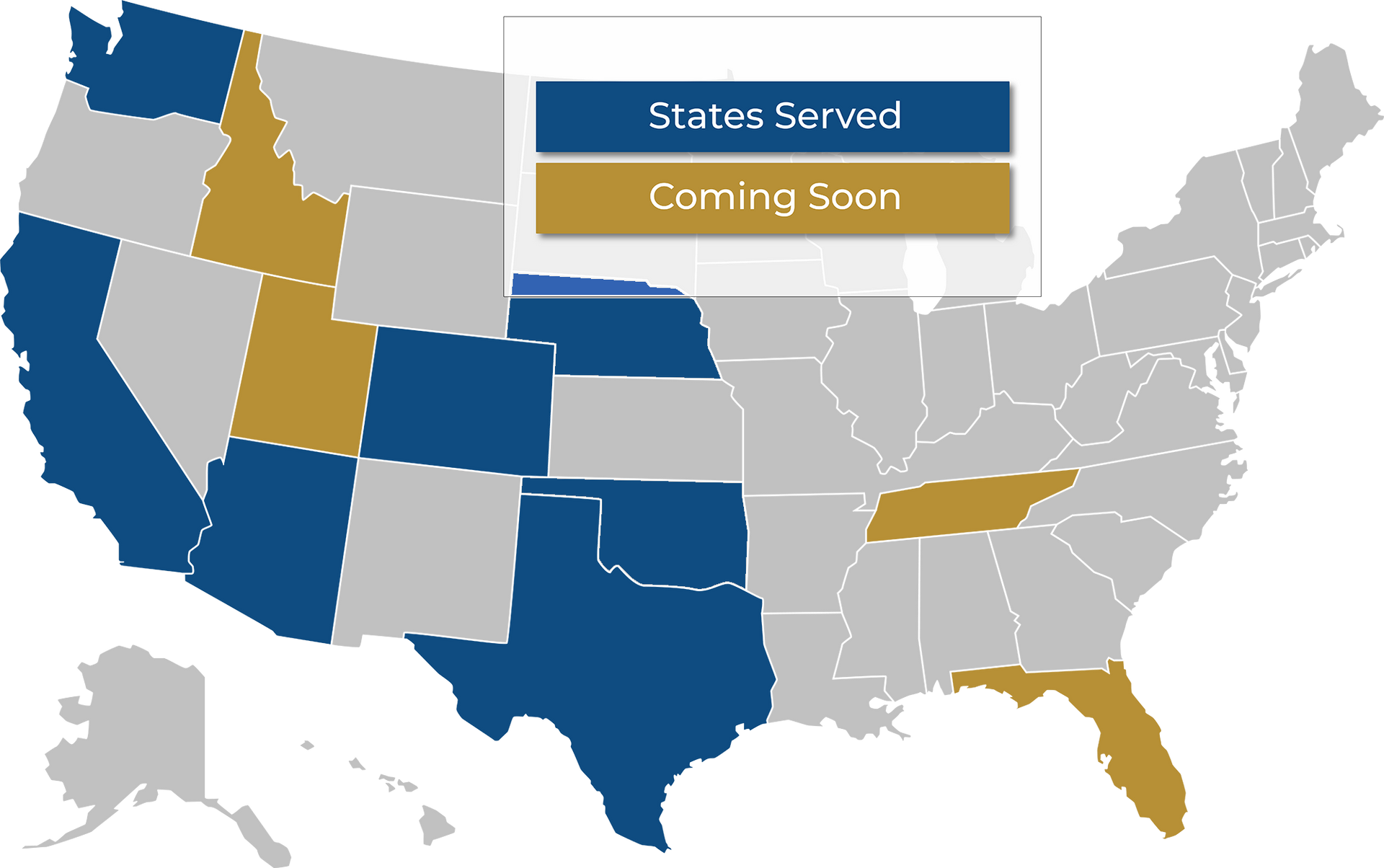

Based in Huntington Beach, our experienced mortgage consultants offer a full range of home loan solutions, including conventional, FHA, VA, jumbo, and home equity financing. We work closely with clients throughout Southern California and beyond, delivering competitive rates, clear communication, and a streamlined process from start to finish.

In addition to traditional loan programs, we also offer flexible solutions for borrowers with non-traditional income. For self-employed professionals, business owners, and investors, we provide access to alternative documentation options—such as bank statement, 1099, and asset-based loans—designed to meet unique financial profiles.

Whether you're looking to purchase a new home, refinance an existing loan, or explore investment property financing, The Mortgage Hub is here to guide you every step of the way. Our team offers no-obligation consultations—with no upfront documents or credit checks required—so you can explore your options with confidence.

Schedule your consultation today and take the first step toward the right mortgage for your goals.

Secure Your Ideal Home Loan Today

Find mortgage consultants in Huntington Beach

Explore Mortgage Solutions

Finding the right mortgage solution can be a daunting task. At The Mortgage Hub, you have access to a range of services designed to simplify this process. Our offerings are crafted to meet your specific needs:

Flexible loan packages

Contact us to discuss your mortgage needs and find the best solution for you.

Embrace Our Unique Approach

The Mortgage Hub stands out in the bustling Huntington Beach landscape by offering services tailored to the local lifestyle. Our consultants, who are also small business owners, understand the unique challenges faced by self-employed individuals. Whether you're navigating the vibrant neighborhoods or enjoying the local culture, our services are designed to fit seamlessly into your life.

With a commitment to excellence since 2009, The Mortgage Hub provides a personalized touch that makes all the difference. Our deep understanding of the local market ensures you receive the best advice possible. Take the leap and connect with us to start your journey toward homeownership.

Contact us today and take control of your homeownership journey.

Your Path to Homeownership

Feel confident in your mortgage choice

Tracy Wu

I had the pleasure of working with Salomon Chong at MortgageHub to secure financing for my family’s new home, and I couldn’t be more grateful for the experience. From the initial consultation to the final closing, he demonstrated professionalism, transparency, and support...

Read More

What stood out most was how responsive and patient Salomon was—every question I had was answered clearly and promptly, and he always made sure I understood each step of the process. Buying a home can be stressful, but the team there made it feel manageable and even enjoyable.

Salomon went above and beyond to find the best loan option that fit my financial goals and timeline. Even with some bumps along the way, he remained solution-oriented and committed to getting the job done smoothly.

I truly felt like a priority throughout the entire process, and I would absolutely recommend Salomon and MortgageHub to anyone looking for a home loan. Thank you for helping me make my dream of homeownership a reality!

Salomon is the man! Seriously, this guy knows his way around lending, is super responsive, gets incredible rates, and can get creative if he needs to with your lending needs. Our friend initially referred us to Salomon with glowing praise, but I just had to check out other lenders to do my due diligence...

Read More

In the end, Salomon shined above the others by orders of magnitude. My wife and I were able to get the loan we needed at the rate we needed to be able to buy our first home because Salomon helped us. If you’re looking for a lender, this is your guy, hands down! Thanks for everything, Salomon- we’re so happy with our first home!

Jarrod Ekengren

Exceptional professionalism and responsiveness from A to Z. We had a 16 day close on a VA loan - signed loan docs with several days to spare. Felix presented multiple financing options up front in detail - we were able to make quick/informed decisions that best suited our needs. Joe ensured that the loan process moved smoothly and efficiently. Salomon was on vacation but STILL made time to answer our questions and ease concerns given the time sensitively of our contract - just great service overall. HIGHLY recommend. This team delivers!

Lorenzo L.

Salomon and the Mortgage Hub team are top notch! Our realtor recommended Sam and They came into our scenario halfway through escrow and we were still able to close smooth, early and saved us a ton from hidden fees our initial loan company had been planning to charge us...

Read More

He will answer your calls/text at anytime and His team is responsive and you can tell he truly cares for each client he works with. We highly recommend him and his team and plan to go back for our future mortgage lending needs. Thank you for the excellent service and experience.

Gloria Bishop