How Desktop Underwriter (DU) and Loan Product Advisor (LPA) Impact Mortgage Applications

Salomon Chong • June 18, 2020

If you’re researching mortgages or in the process of applying for a mortgage, you’ve likely come across the names Desktop Underwriter and Loan Product Advisor. But if your lender or loan officer tries to explain what they do, it might leave you at a loss.

Desktop Underwriter (DU) and Loan Product Advisor (LPA) are complex pieces of software that automatically assess your risk and use set guidelines to approve or reject your mortgage. But there’s a lot more to them than that. Below we’ll discuss DU and LPA, what role they play in the mortgage processes, how to get approved, and the value of approval.

What are DU and LPA?

Both DU and LPA are automated underwriting systems (AUS), which are computer applications that verify your personal information and determine whether you should be approved or rejected for a mortgage.

Loan officers will almost always use DU or LPA to help them decide whether to approve your loan. It’s like a digital gut check to see if you’re a good candidate for a mortgage.

How Fannie Mae and Freddie Mac Are Involved

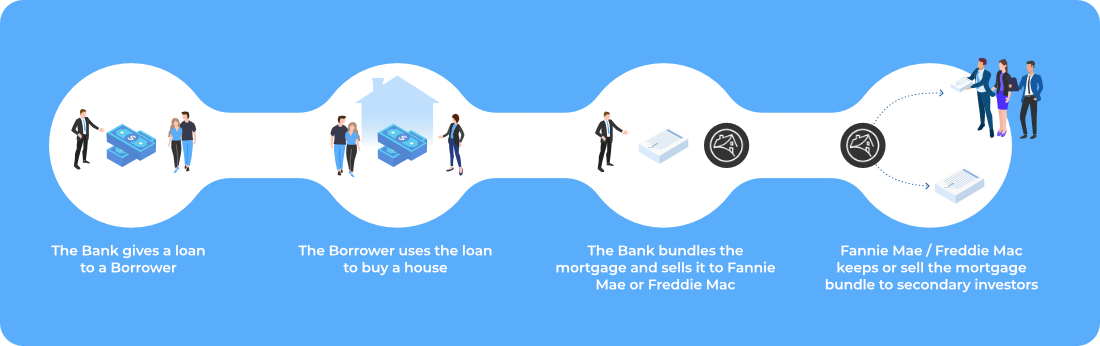

Now that you have a basic understanding of DU and LPA, it’s important to understand how Fannie Mae and Freddie Mac are involved in this process. Fannie and Freddie are massive government-sponsored enterprises that buy mortgages from lenders. So when you take out a mortgage to purchase a home, your lender turns around and usually sells that loan to Freddie Mac or Fannie Mae. Fannie Mae and Freddie Mac either hold these mortgages or package and sell them to investors.

This process allows your lender to use the proceeds from the sale of your loan to make more loans.

But Freddie and Fannie have to be careful about what loans they purchase, so they created DU and LPA to help assess risk.

Desktop Underwriter is the AUS run by Fannie Mae and Loan Product Advisor (formerly called Loan Prospector) is the AUS run by Freddie Mac. Both DU and LPA use algorithms to decide whether a mortgage meets Fannie Mae or Freddie Mac’s eligibility requirements.

Examples of what Freddie and Fannie’s algorithms look for in borrowers include:

- Debt-to-income ratio

- Cash reserves

- Credit score

- Collateral.

DU and LPA’s Role In Mortgage Approval

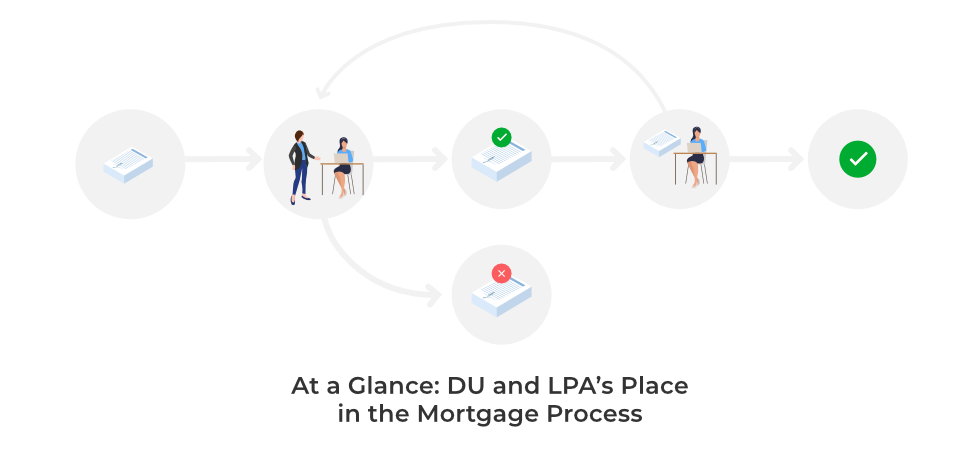

When you start a mortgage application, a loan officer collects information from you such as information about your income, employment history, credit score, credit history, assets, and more. Then that information is submitted to DU or LPA. Following this, those systems review the info, compare the data to Fannie and Freddie’s guidelines, and then approve or deny your application.

Initial DU or LPA approval from your loan officer doesn’t mean you’re guaranteed to be approved for the mortgage. If you do get initial approval, then the loan officer verifies your information one more time and submits it to the AUS again.

Finally, DU or LPA will issue conditions that have to be met. And once you satisfy those conditions, then your loan is ready to close.

A Better Chance at Mortgage Approval

While it may seem like a fairly simple step in the mortgage process, there’s a lot of weight placed on whether DU or LPA approve your application. You should do everything you can to meet requirements that will satisfy the AUS and a good loan officer should be able to help walk you through that. If you can get a DU or LPA loan approval early, it can also help differentiate you from other homebuyers because it shows you are more serious and prepared.

If you need help navigating through the mortgage process or have questions about getting approvals from an automated underwriting system, our team at The Mortgage Hub can help guide you. Find out more with a free consultation.

Glossary

Still feeling a little confused? Here are some terms that can help you sort it out:

- Automated Underwriting System (AUS): Software that assesses whether you should be approved or rejected for a mortgage

- Desktop Underwriter (DU): The AUS created by Fannie Mae

- Fannie Mae: A government-sponsored enterprise that buys mortgages from lenders, which also goes by the name Federal National Mortgage Association

- Freddie Mac: A government-sponsored enterprise that buys mortgages from lenders, which also goes by the name Federal Home Loan Mortgage Corporation

- Loan Product Advisor (LPA): The AUS created by Freddie Mac

- Loan Officer: Someone who works for a bank or lender who works closely with a borrower to get information and process mortgage applications

Need Help with Your Mortgage Application?

Schedule a Free Consultation or call now at (888) 273-8734 to get all your questions answered by a Mortgage Consultant.